do nonprofits pay taxes on donations

If you receive a donation it might be subject to the federal gift tax but you wont have to pay that tax. Amount and types of deductible contributions what records to keep and how to report contributions.

A Brief History Of Charitable Giving Infographic Charitable Giving Infographic Charitable

The donor pays the gift tax not the recipient of the gift.

. You pay use tax when the seller does not collect sales tax at the time of sale for example items purchased over the Internet and by mail order Use tax is paid on the Excise Tax Return or. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Any nonprofit that hires employees will also.

There are some instances when nonprofits and churches are still required to pay taxes. Which Taxes Might a Nonprofit Pay. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

To be tax exempt most organizations must apply for recognition of. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

So the first umbrella income related to your exempt purpose is relatively simple. Charitable educational scientific or literary. Generally donations of gift cards gift certificates checks cash or services are not subject to tax since there is not an exchange of merchandise or goods.

Sunday April 24 2022. Still most are exempt under Section 501 c3 which gives an exemption to charitable organizations and lets donors deduct their charitable contributions. Another would have revoked property tax exemptions for nonprofits that pay executives more than 250000.

However items withdrawn from resale inventory and donated to organizations such as nonprofit museums art galleries and libraries are not taxable. Two bills in the Montana Legislature that threatened nonprofit property tax exemptions were tabled. Section 501 c of the US.

Donations are tax-deductible for donors. For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. Tracking nonprofit donations.

Many nonprofits are exempt from most federal income taxes and some state taxes such as sales and property taxes. But if you make a 10000 tax-deductible donation to the government you will only be taxed on the 40000 you have remaining and thus you will only owe the federal government 8000 instead of 10000. Nonprofit organizations are exempt from federal income taxes under subsection 501 c of the Internal Revenue Service IRS tax code.

Even though the federal government awards federal tax-exempt status a state can require additional documentation to. The biggest thing to remember is that nonprofits will not be paying out profits which is why they are called nonprofits in the first place. Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces.

One of the best ways you can encourage people to donate to your non-profit organization is by assuring them that their donation is tax-deductible. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Do i need to pay tax on donations that were given to me.

Common activities that are usually not taxed because they are related to a nonprofits purpose. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes. Donations are a critical piece of nonprofit accounting basics.

State tax exempt benefits vary by state but most include. There are clear rules as well as several exceptions to. However they arent completely free of tax liability.

Most nonprofits have paid staff. Do nonprofits pay taxes on donations. For the 2021 tax year you can deduct up to 300 per person rather than per tax return meaning a married couple filing jointly could deduct up to 600 of donations without having to itemize.

Here we break down what tax deductible means and how you can use it to your advantage. Some have thousands of employees while others employ a couple of key people and rely on. Federal Tax Obligations of Non-Profit Corporations.

As nonprofit organizations raise funds and solicit donations tracking and properly recording monetary contributions becomes an important function as donors require detailed receipts to claim tax deductions. Also donors may be able to take a tax deduction for their donations to these organizations. Keep in mind that gifts to political organizations and qualifying organizations are exempt from this rule.

Nonprofit corporations by definition exist not to make money but to fulfill one of the purposes recognized by federal law. A searchable database of organizations eligible to receive tax-deductible charitable contributions. There are certain circumstances however they may need to make payments.

Under state and federal tax laws however as long as a nonprofit corporation is organized and operated for a recognized nonprofit purpose and has secured the proper tax exemptions it can take in more money than. Do nonprofits pay taxes. For the most part nonprofits are exempt from most individual and corporate taxes.

Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations. State and local property taxes state income tax and sales tax on purchases. One would have required charitable nonprofits to pay property taxes for ten years on any new real property purchased or donated.

How donors charities and tax professionals must report non-cash charitable contributions. View solution in original post. However this corporate status does not automatically grant exemption from federal income tax.

Internal Revenue Code lists 27 types of nonprofit organizations exempt from tax. In short the answer is both yes and no. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

So the first umbrella income related to your exempt purpose is relatively simple. Nonprofit organizations must pay sales tax to the seller at the time of purchase. The research to determine whether or not sales tax is due lies with the nonprofit.

Non Profit Budget Budget Template Donation Letter Template Budgeting

Browse Our Example Of Non Profit Donation Receipt Template Receipt Template Donation Letter Non Profit Donations

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budgeting Budget Spreadsheet

Charitable Donations H R Block Best Time To Study Credit Card Infographic Infographic

Difference Between Charity Business Administration Think Tank

Nonprofit Startup Checklist Nonprofit Startup Start A Non Profit Non Profit

Pin By Michelle Higgins On Nonprofits In 2021 Financial Responsibility Non Profit Executive Director

Sponsorship Levels Event Sponsorship Donation Letter

Food Companies That Donate To Non Profit Organizations Fundraising Nonprofit Fundraising Non Profit

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Charity Fundraising Non Profit Donations

Fundraising Nonprofit Raisingfundstips Sponsorship Proposal Charitable Contributions Nonprofit Fundraising

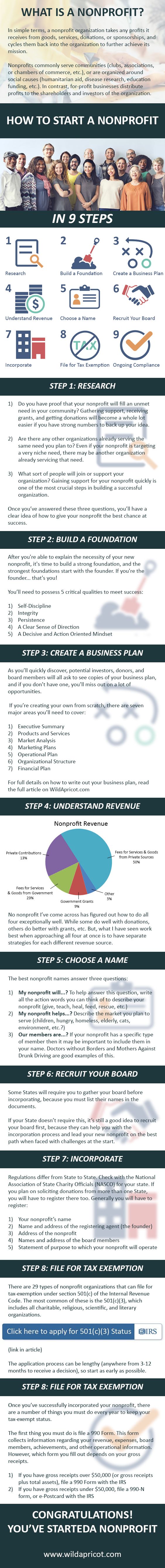

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Payroll Tax Increase Expected To Suppress Charitable Giving Payroll Taxes Charitable Giving Payroll

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities

Different Concepts For Nonprofit Organizations Start A Non Profit Nonprofit Startup Nonprofit Marketing

Must Have Elements Of Every Nonprofit Mission Statement Mission Statement Examples Mission Statement Creating A Mission Statement